Legal Framework

Different Legal Status of Nonprofit Organizations in Japan

The term “NPO” entered the Japanese vocabulary around the time of the enactment of Law to Promote Specified Nonprofit Activities in 1998, which is now known as the “NPO law.” The corporate entities created by this law – Specified Nonprofit Corporations – are generally referred to as “NPO corporations.” Needless to say, “NPO” is made up of the initials of the English words Non-Profit Organization, or Not-for-Profit Organization.

Understanding “NPO” in a Japanese Context: Narrow and Broad Definitions of NPO

In Japan, the term “NPO” (Non-Profit Organization) is often narrowly equated with “NPO corporations” by many people. However, this is a somewhat limited interpretation.

More broadly, “NPO” actually refers to a wide array of civil society organizations and diverse private, voluntary activities, regardless of their specific legal structure. This wider definition includes everything from unincorporated citizen groups operating at the grassroots level to long-standing neighborhood and village associations commonly found in rural areas.

On the other hand, the term “NPO” can also encompass more established entities (or corporate types) like Public Interest Corporations (which include Public Interest Foundations and Public Interest Associations). These often have a longer history and a broader regional reach than NPO corporations. Additionally, the broader definition of NPO can extend to Social Welfare Corporations, Private School Corporations, Medical Corporations, and Religious Corporations.

These diverse categories of Japanese organizations could be broadly classified similarly to 501(c)(3) organizations, which are the most widely recognized type of nonprofit corporation in the United States.

Furthermore, if we expand the definition of a nonprofit to include mutual interest organizations, then entities working for a common cause—like consumers’ cooperatives and labor unions—can also be considered a type of “NPO.”

Collectively, these various layers of NPOs form the backbone of Japan’s civic sector.

NPO Corporations and Certified NPO Corporations

An NPO Corporation falls under the jurisdiction of either the prefecture where its main office is located or a government-designated city. After completing the required procedures and submitting the necessary documents to the jurisdiction office, the organization is “authenticated” as an NPO Corporation, provided it meets the established criteria. As of May 2025, there were 49,381 NPO Corporations.

NPO corporations that meet the standard conditions, including clearing the Public Support Test (PST), and are “accredited” by the director of the National Tax Administration Agency become Certified Specified Nonprofit Corporations (or Certified NPO Corporations), making them tax-deductible. Donors who contribute to these Certified NPO Corporations are eligible to receive income tax deductions under the current tax system.

It is hoped that an increase in the number of Certified NPO Corporations will lead to a rise in donations to NPOs overall. As of May 2025, there were 1,300 Certified NPO Corporations, making up less than 3% of all NPO Corporations.

Background: The Emergence of NPO Corporations in Japan

Prior to the enactment of Japan’s NPO Law, organizations in Japan that sought corporate status without the intention of distributing profits typically became Public Interest Corporations. These included entities like Public Interest Associations and Public Interest Foundations, established under Article 34 of the 1896 Civil Code.

However, becoming a Public Interest Corporation presented significant challenges for many citizen organizations. The process demanded adherence to strict establishment conditions and subjected their activities to a top-down system of government supervision. This level of stringent oversight proved unsuitable for groups desiring more autonomy. Consequently, numerous organizations opted to remain private, unincorporated entities.

Interestingly, when a formal corporate structure was deemed necessary, these non-profit-oriented organizations sometimes resorted to forming joint stock companies and limited liability companies, despite their core objective not being profit generation.

These circumstances spurred a movement among citizen groups starting in the 1980s. They began advocating for a new nonprofit corporation system. Their aim was to establish a legal framework that would explicitly acknowledge their lack of profit motivation and grant them a greater degree of freedom by significantly reducing government oversight. This advocacy ultimately laid the groundwork for the NPO Law in 1998.

Public Interest Corporations

Public Interest Corporations (Public Interest Associations and Public Interest Foundations, sometimes referred to as Public Interest Incorporated Associations/Foundations) are organizations that carry out government-sanctioned public interest projects and receive approval to establish themselves based on the regulations of the Civil Code (Article 34), enacted in 1896. In 2008, Public Interest Corporation reforms were introduced. Today, under Reform Law 3, public interest approval councils (similar to the UK’s charity commissions) evaluate organizations to determine whether they meet specific criteria, such as having public interest projects as their primary objective. Once an organization receives approval from the relevant administrative authority (either the Cabinet Office or a prefectural government), it becomes a Public Interest Association or Public Interest Foundation. These corporations benefit from preferential treatment under the tax system.

General Corporations

With the Public Interest Corporation reforms in 2008, a new category of corporate entities called General Corporations was introduced. As long as the requirements of corporate law are met, a General Association or General Foundation (also referred to as a General Incorporated Association/Foundation) can be established through a simple registration process, making it relatively easy to obtain corporate status. Following the Great East Japan Earthquake in 2011, many groups involved in relief efforts chose to become General Associations due to the ease of incorporation, as opposed to NPO Corporations, which still require several authentication hurdles to incorporate.

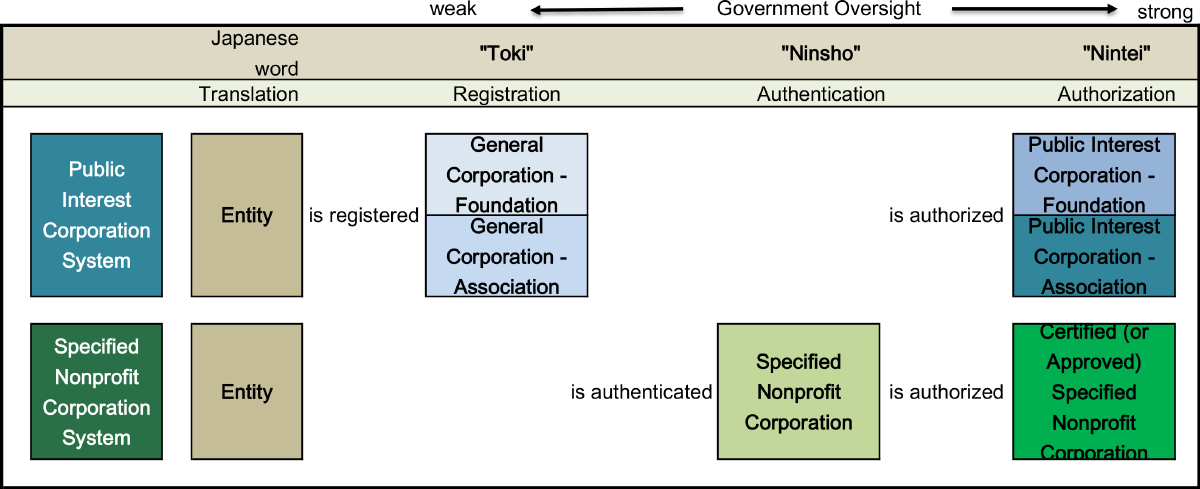

There is now an equivalence between NPO Corporations obtaining Certified NPO Corporation status and General Corporations obtaining Public Interest Corporation status, with the key advantage of the latter being that donors can receive tax deductions. This relationship can be illustrated as follows.

Two-Stage System of Obtaining Donor Tax Deductions

Social Welfare Corporations

Social Welfare Corporations are established under the Social Welfare Law of 1951 to carry out social welfare programs. These organizations manage facilities such as daycare centers for disabled and elderly individuals. This category also includes social welfare councils organized by prefectures or municipalities, which aim to promote community-based social services and support volunteer activities. Additionally, they oversee charity collections that raise funds for promoting and educating the public about welfare activities. As of April 2021, there are approximately 21,000 Social Welfare Corporations in Japan.

Medical Corporations

Medical Corporations were established under the Medical Law of 1948 and have been forming since 1950. The creation of a Medical Corporation requires approval from the prefectural governor, and the decision involves consulting the prefectural Council on Medical Service Facilities. As of March 2024, there are approximately 59,000 Medical Corporations.

Private School Corporations

Private School Corporations are entities established under the Private School Law of 1949 for the purpose of founding private schools. As of 2021, there are approximately 7,600 such corporations. They are classified as Public Interest Corporations under tax law and fall under the jurisdiction of the Ministry of Education.

Religious Corporations

Religious Corporations are religious organizations based on the Religious Corporation Law of 1951, and the main purpose of these organizations is “spreading religious doctrine, conducting ceremonial events, and working toward the enlightenment and cultivation of believers.” Their corporate approval process is under the jurisdiction of the Ministry of Education, but once they have been approved, Religious Corporations are not subject to further government oversight. As of December 2022, there are over 179,000 Religious Corporations, making them the most numerous type of nonprofit corporation.