Posted on March 22, 2023

In 2018, Japan NPO Center (JNPOC) started a news & commentary site called NPO CROSS to discuss the role of NPOs/NGOs and civil society as well as social issues in Japan and abroad. We post articles contributed by various stakeholders, including NPOs, foundations, corporations, and volunteer writers.

For this JNPOC’s English site, we select some translated articles from NPO CROSS to introduce to our English-speaking readers.

The Act on the Prevention of Malicious Donation Solicitations by Organizations enacted: Summary of key takeaways

Kenji Yoshida, Managing Director, Japan NPO Center

On December 10, 2022, the Act on the Prevention of Malicious Donation Solicitations by Organizations was enacted. The government presented an outline on November 18, and the Cabinet approved the bill on December 1. This is an exceptionally fast passage of the law, only nine days from the date of its approval. With the enactment of the law, we hope that it will serve as a deterrent to the practice of maliciously soliciting donations.

Now that this new law has been passed, in this article, I would like to consider some key points to keep in mind and discussions regarding the application of this law.

Outline of the Act

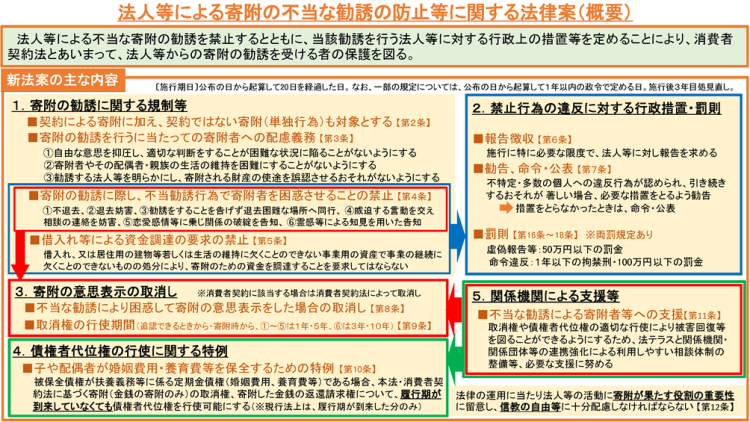

Outline of Act on the Prevention of Malicious Donation Solicitations by Organizations

from the Consumer Affairs Agency’s website

According to the Act, its purpose is to “prohibit the unjust solicitation of donations by juridical persons and others, and to provide for administrative measures against such persons, in order to protect those who receive solicitations for donations from juridical persons, in conjunction with the Consumer Contract Act.” The first key point is the term “juridical person,” which includes associations without legal status. Donations collected by any organization targeting individual donors are covered by the law, including unincorporated voluntary groups, while donations collected by individuals are not covered in this act. Another key point is that there is a reference to the Consumer Contract Act.

When it comes to regulations regarding donation solicitations, the law stipulates that consideration must be given to the donor; it also defines prohibited improper solicitation activities. In the event of a violation of a prohibition, the government may request a report collection, recommendation, order, or public announcement, and there are penalties for false reporting or violations of government orders. Donors may rescind their declaration of intent to donate if they were misled by improper solicitation activities. In addition, a child or spouse may exercise the right of subrogation against creditors to demand the return of the donation, including the portion not yet due for performance, in order to preserve marital and child support expenses.

On the other hand, the law also states the following, giving consideration to the concerns expressed by NPOs: “In administering this Act, the importance of the role played by donations in the activities of juridical persons shall be noted, and sufficient consideration shall be given to the academic freedom, religious freedom, and freedom of political activity of individuals and juridical persons.”

Impact on NPOs

What are the possible effects of this act on NPOs and other nonprofits?

Questions have been raised in the Diet regarding the impact on NPOs. The Consumer Affairs Agency has stated, referencing the same provision quoted in the previous paragraph of this article regarding the importance of the role played by donations and the various freedoms to be enjoyed by individuals and organizations alike, that the Act will have no impact on “the donations solicited in a proper manner.”

As per the Consumer Affairs Agency’s response, I also believe that, essentially, a major problem has been avoided in the solicitation of donations normally conducted by NPOs. In particular, it is difficult to imagine that the normal ways in which donations are solicited by NPOs and other nonprofits would be considered a “prohibited act” as stipulated in Article 4.

The “duty of care” stipulated in Article 3 is also unlikely to be a major problem for NPOs as well. However, this article needs more careful attention than Article 4. With regard to the provision “to ensure that there is no risk of misleading as to the use of the donated property” (Article 3, Item iii), which was of particular concern, the following answer was given by the Consumer Affairs Agency at the questioning by the government’s Special Committee on Consumer Affairs on December 6, 2022:

Toru Kunishige, Member of the House of Representatives (Komeito Party):

(On the duty of care under Article 3, Item iii) “Is it correct to say that there is no issue as long as it is not actively misleading? For example, even if donations collected to support disaster victims are used for shipping or labor, it does not violate the duty of care under Item iii, because these are necessary expenses in supporting disaster victims?”

Takeshi Kuroda, Deputy Director, Consumer Affairs Agency:

“Just as you have pointed out, if it is not actively misleading the public, then it would not be considered misleading if donations are collected to support disaster victims and a portion of the donations are allocated as necessary expenses. However, we would like to ask nonprofits to provide a clear explanation because the general public has a wide range of conceptions of expenses.”

[Transcribed by the author from the live broadcast of the Diet session]

“There is no issue as long as it is not actively misleading” is a rather important note as it confirms that NPOs can resolve or prevent problems by setting the right tone for the donors when soliciting donations.

However, the provision in Article 3, Item ii, which states that “it shall be ensured that the donation does not make the maintenance of livelihood difficult for the individual, his/her spouse, or relatives,” is a difficult one for NPOs to manage, as it is usually impossible to ascertain the detailed living conditions of the donor. Since it was not made clear at this time how exactly one can manage this provision, this remains a point to be confirmed in the explanations of each article and guidelines to be published in the future.

In addition, this new act has linked the donation, whose legal position had been ambiguous, to the Consumer Contract Act by stating that to donate is to enter a “gift contract.” Further commentary is expected on whether there is anything additional that needs to be done to respond to what is required by the Consumer Contract Act.

As the Consumer Contract Act begins with the words, “In consideration of the disparity in the quality and quantity of information and negotiating power between consumers and traders,” this law is intended to protect consumers based on the existence of this disparity. Donations, on the other hand, are not necessarily the case. The National Tax Agency explains that a donation is “the amount of money, goods, or other economic benefit given as a gift or gratuitous grant, or the value at the time of the gift or grant”

[1]. It also states that “mere gifts, donations, subsidies, or compensation for damages, do not, in principle, constitute transactions for consideration”

[2]. As can be read from this, since it is assumed that there is no counter benefit (consideration), the donor is basically not disadvantaged even if he/she cancels the donation. Therefore, the relationship between donors and NPOs differs in some respects from that between consumers and traders/businesses. Since donors are also associates who share the same goals as nonprofits, it is questionable whether it is appropriate to consider donor protection in the same manner as consumer protection.

Things to Consider

On the other hand, we can assume that there does exist a gap in information between donors and NPOs. For example, when a donation is solicited using an illustrative image photo, it is possible that this may cause misunderstanding. We also do not want the donors’ livelihoods to be threatened as a result of their donations.

In light of this, it is important for NPOs to make every effort to carefully communicate their intents and actions with donors, regardless of whether or not NPOs are affected by this new law. Lack of such communication resulting in disappointment among donors would be frustrating to NPOs as well.

Regarding “donations solicited in a proper manner,” which was the expression used by the Consumer Affairs Agency in its answer to the Diet, it has not been specified what exactly that means. I believe that it is more of a question on our part as to what is considered “proper.” Similarly, with regard to the statement, “We hope nonprofits will give a full explanation because the general public has a wide range of concepts about expenses,” it must be taken for granted that project and financial reports be provided to donors. But in practice, the method, timing, frequency, and content of such reports vary from one organization to another, and it all the more necessary to create a certain common understanding of what “clear explanation” entails.

There is a need for us to reexamine how NPOs can communicate with donors better, such as in explaining and reporting how donations are being spent, and for NPOs to gain the trust of society through their actions as they demonstrate a standard for proper solicitation of donations.

I hope that this discussion will serve as an opportunity to foster an appropriate donation culture in Japan. And I hope that we can have this new act, which has been commonly referred to as the “Donation Regulation Act” when discussed, be referred alternatively as the “Donation Promotion Act” in the future.